FY 2025 Monthly Revenue Assessment Report for August 2024

Providence, R.I. — The Office of Revenue Analysis (ORA) today released its FY 2025 Revenue Assessment Report for August 2024. This monthly report compares the adjusted general revenues by revenue source on a fiscal year-to-date and monthly basis to expected general revenues by revenue source. Expected general revenues are estimated by the ORA from the revenue estimates included in the FY 2025 enacted budget signed into law on June 16, 2024.

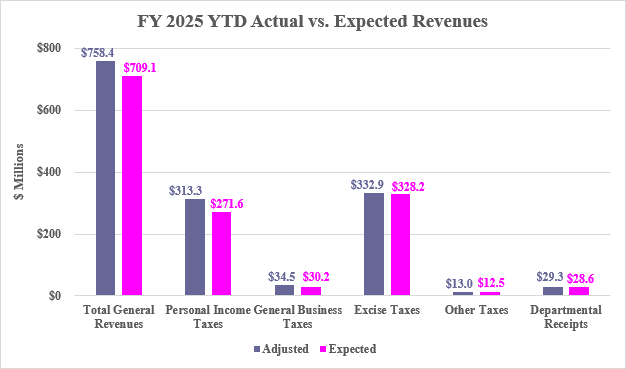

August Year-To-Date Performance. ORA finds that FY 2025 adjusted total general revenues through August led the enacted FY 2025 expected total general revenue estimates through August by $49.3 million, a variance of 6.9%. Most of this variance was due to personal income tax revenue being up by $41.7 million. This positive variance was caused by the delayed due date for personal income tax (and business taxes) from April/June 2024 to July 15, 2024. Those delayed personal income tax payments totaled $43.3 million. In addition, sales and use tax exceeded estimates by $3.4 million. On a year-to-date cash basis, sales and use tax grew by 4.1%.

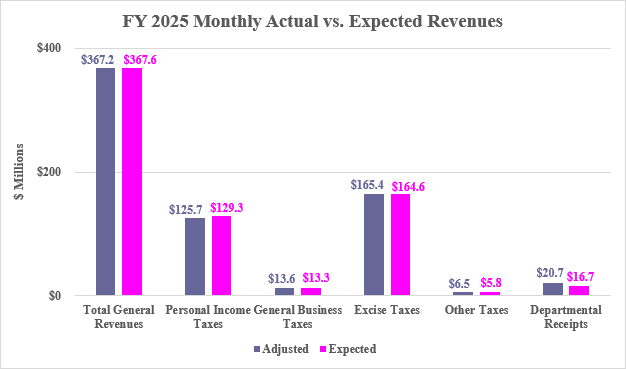

August Monthly Performance. ORA finds that August 2024 adjusted total general revenues trailed the expected total general revenues estimates for August by $0.4 million, a variance of -0.1%. This variance was driven by personal income tax collections, which were down $3.6 million to estimates due to withholding payments being down $6.8 million. This was offset by strength in insurance company revenue and departmental receipts, which exceeded estimates by $2.3 million and $4.0 million respectively.

The entire report can be found on the Department of Revenue’s web site at https://dor.ri.gov/revenue-analysis/fy-2025.

Questions or comments on the report should be directed to Paul Grimaldi, Chief/Program Development, by e-mail at paul.grimaldi@revenue.ri.gov or by phone at (401) 378-1080.