Guidance on Rhode Island tax treatment of unemployment benefits

Division reminds taxpayers and tax preparers about existing Rhode Island statute

PROVIDENCE, R.I. – The Rhode Island Division of Taxation today provided guidance explaining that Rhode Islanders will be able to deduct up to $10,200 of unemployment compensation on their federal personal income tax returns under a recent federal law change, but must include that same amount as income on their Rhode Island state income tax returns under current Rhode Island law.1

Normally, unemployment benefits are subject to both federal and Rhode Island personal income tax. Under federal legislation enacted on March 11, 2021, if a taxpayer received unemployment benefits in 2020 and the taxpayer’s federal adjusted gross income (AGI) was less than $150,000 for 2020, the first $10,200 of the taxpayer’s unemployment benefits is excluded from income for federal tax purposes for 2020.2

In contrast to the federal law, for Rhode Island tax purposes, existing Rhode Island law remains unchanged with respect to the tax treatment of unemployment benefits. Thus, for Rhode Island personal income tax purposes, unemployment compensation continues to be included as income.

“Rhode Island will follow current Rhode Island law regarding the Rhode Island tax treatment of unemployment compensation,” said Rhode Island Tax Administrator Neena Savage. “While Rhode Islanders will receive a benefit at the federal level, the Division will follow the current Rhode Island law for Rhode Island personal income tax purposes which requires that unemployment compensation be taxed,” she said.

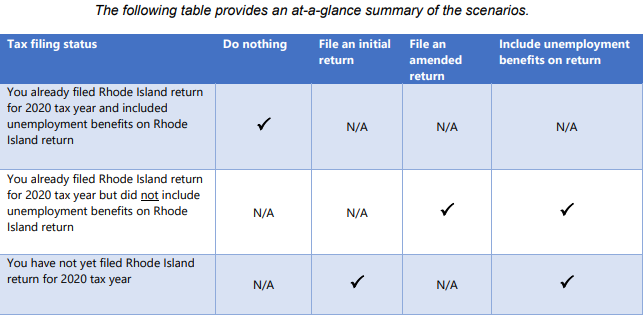

The following 3 circumstances apply to tax year 2020 filings:

Already filed, included unemployment compensation: If you already filed your Rhode Island personal income tax return for 2020 and included your 2020 unemployment benefits as income, you need not take any further steps (assuming you have filed a complete and accurate return). There is no need to file an amended Rhode Island return if your original filing included all of your unemployment compensation.

Already filed, did not include unemployment compensation: If you already filed your Rhode Island personal income tax return for 2020 and did not include your 2020 unemployment benefits as income, you must file an amended Rhode Island personal income

tax return for 2020 and include in your income (“add back” to income), for Rhode Island purposes, the amount of your 2020 unemployment benefits. Further details on this procedure are included elsewhere in this Advisory.

Not yet filed: If you have not yet filed your Rhode Island personal income tax return for 2020, remember to include your 2020 unemployment benefits as income for Rhode Island tax purposes — regardless of how those benefits are treated for federal tax purposes.

Background and explanation

Federal legislation enacted on March 11, 2021, provides a partial exclusion from income for unemployment compensation received in 2020.3 Thus, in general, a taxpayer with less than $150,000 of federal adjusted gross income for 2020 may exclude, from income for federal tax purposes, up to $10,200 in unemployment benefits received in 2020.

However, under Rhode Island General Laws § 44-30-12, resident and nonresident taxpayers must include as income — for Rhode Island tax purposes — any unemployment compensation received but not included in federal adjusted gross income.4

In other words, although a portion of one’s unemployment benefits may not count as income for federal tax purposes, all of one’s unemployment benefits count as income for Rhode Island tax purposes. How this tax treatment is applied depends on when the taxpayer filed (or files) his or her return.

Examples

Each of the following examples assumes that the taxpayer had unemployment compensation in 2020. Each example involves the Rhode Island personal income tax return covering the 2020 tax year.

Example #1

TAXPAYER ALREADY FILED RETURN, INCLUDED UNEMPLOYMENT BENEFITS ON RETURN:

Joseph had income of $35,000 in 2020, including $30,000 in wages and $5,000 in unemployment benefits. When he filed his Rhode Island personal income tax return earlier this year, the amount on line 1 of his return included $35,000 (his wages and his unemployment benefits). Joseph does not have to take any further steps regarding his 2020 Rhode Island personal income tax return (assuming he has filed a complete and accurate return). There is no need for Joseph to file an amended Rhode Island return, assuming that his original filing included all of his unemployment compensation.

Example #2

TAXPAYER ALREADY FILED RETURN, DID NOT INCLUDE UNEMPLOYMENT BENEFITS ON RETURN:

Maria had income of $45,000 in 2020, including $40,000 in wages and $5,000 in unemployment benefits. When she filed her Rhode Island personal income tax return earlier this year, it included her $40,000 in wages but did not include her $5,000 in unemployment benefits. Maria must now file an amended Rhode Island personal income tax return for 2020 and include her entire $45,000 of income.

✓ Note: Rhode Island recently postponed its due date for individual income tax returns and payments to May 17, 2021.

Thus, in this example, Maria has this same extra time to complete and file her amended Rhode Island personal

income tax return and pay any amount due. Assuming she files her amended Rhode Island return and pays any

amount due by May 17, 2021, she will avoid any late charges.

Example #3

TAXPAYER HAS NOT YET FILED RETURN:

Jane had $55,000 in income in 2020, including $45,000 in wages and $10,000 in unemployment benefits. She has not filed her Rhode Island personal income tax return yet. When she does file her 2020 Rhode Island personal income tax return, she must include all $55,000 (her wages plus her unemployment benefits) on her Rhode Island return.

✓ Note: Because Rhode Island recently postponed its due date for Rhode Island personal income tax returns and

associated payments to May 17, 2021, Jane has until May 17, 2021, to file her Rhode Island return and pay any

amount due in order to avoid late charges.

Questions and answers

Q: On what form will a taxpayer include unemployment compensation in income for Rhode Island personal income tax purposes?

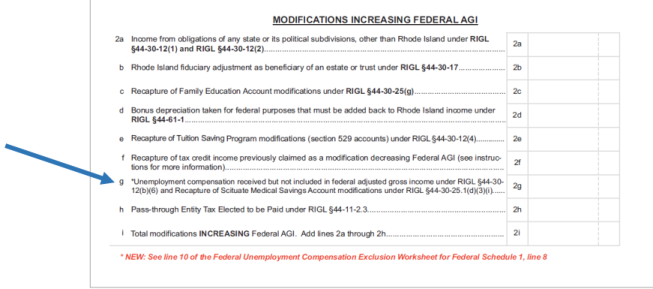

The Division is revising Schedule M (“RI Modifications to Federal AGI”) for this purpose. Unemployment compensation that was received by the taxpayer but not included in federal adjusted gross income for Rhode Island purposes will be “added back” to one’s Rhode Island income via line 2g of the revised Schedule M. (See screenshot below.)

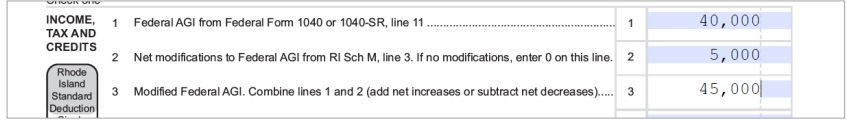

When the taxpayer enters his or her various modifications, the taxpayer then combines, on Schedule M, the total modifications decreasing federal adjusted gross income for Rhode Island purposes and the total modifications increasing federal adjusted gross income for Rhode Island purposes. The result is entered not only on Schedule M, but also on the front page (line 2) of the taxpayer’s Form RI-1040 or Form RI-1040NR.

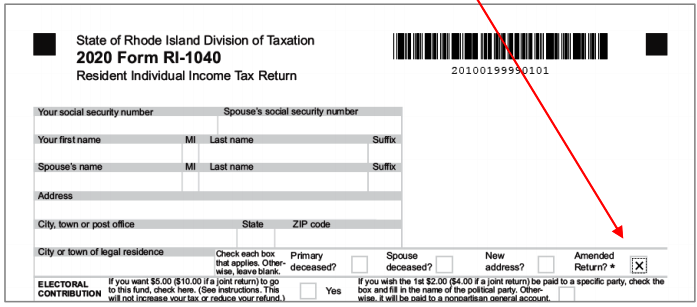

Q: How do I file an amended Rhode Island personal income tax return?

There used to be one form for filing a Rhode Island personal income tax return, another form for filing an amended return. No longer. Nowadays, if you want to file an amended Rhode Island return, use Form RI-1040. Fill it out as if you were doing your Rhode Island personal income tax return all over again.

Just make sure to first check the “Amended Return” box (see screenshot below).5

In filling out an amended return, you must include not only a revised Schedule M (and recalculate your return accordingly), but also remember to take all of the steps you normally would in order to file a complete and accurate return.

For example:

▪ Include all of the schedules you included on your original return – whether they have changed or not – including Schedule W and Schedule E.

▪ If you (and your dependents, if applicable) had sufficient health insurance coverage for all of 2020 – through employer-sponsored health insurance, the federal Medicare health insurance program, or some other means – remember to check the box on the front of your return indicating that you had such coverage for all of 2020.

▪ If you (or your dependents, if applicable) did not have sufficient health insurance coverage for all of 2020, you may be subject to a penalty. You may be able to limit the impact of the penalty – or avoid it altogether – if you qualify for an exemption. See the forms and instructions for details – especially Form IND-HEALTH and its instructions.

▪ Remember to include the “Explanation of Changes” supplemental page (see links toward the end of this Advisory).

▪ Also, as mentioned above, remember to include the revised Schedule M (see links toward the end of this Advisory).

Q: Can I e-file my amended Rhode Island personal income tax return for 2020?

The Division is working with tax software providers to ensure that they include the revised version of Schedule M in their programs so that unemployment compensation that was received by the taxpayer in 2020 is properly included in the taxpayer’s income for Rhode Island tax purposes.

If you received unemployment benefits in 2020, and you have already filed your Rhode Island personal income tax return but did not include unemployment benefits as income on that return, the Division recommends that you hold off on e-filing your amended Rhode Island return until your tax software provider has updated your program to include the revised version of Schedule M and any related changes.

If you received unemployment benefits in 2020, and you have not filed your Rhode Island personal income tax return yet, the Division recommends that you hold off on e-filing your Rhode Island return until your tax software provider has updated your program to include the revised version of Schedule M and any related changes.

5 If you included your 2020 unemployment benefits as income on the 2020 Rhode Island personal income tax return you filed earlier this calendar year, then filed an amended 2020 Rhode Island personal income tax return to exclude your 2020 unemployment benefits, you must now file another amended 2020 Rhode Island personal income tax return to include your 2020 unemployment benefits.

Q: Could you provide links to the forms mentioned in this Advisory?

The Division is in the process of updating its forms and instructions to make clear the Rhode Island tax treatment of unemployment benefits. When that process is completed, the updated forms and instructions will be available via the following link:

http://www.tax.ri.gov/taxforms/personal.php

You also can find the Rhode Island “Explanation of Changes” supplemental page at:

http://www.tax.ri.gov/forms/2020/Income/Amended%20Supplement_b.pdf

The updated forms posted will include the Rhode Island Form 1040, Rhode Island Form 1040NR, revised instructions, and Rhode Island revised Schedule M.

Q: Is there anything else I need to know?

The Division has been able to identify a certain number of Rhode Island personal income tax returns on which taxpayers did not include their unemployment benefits from 2020 (perhaps because the taxpayers assumed that Rhode Island would follow the federal legislation, signed into law March 11, 2021, involving the federal tax treatment of unemployment benefits).

The Division will hold those returns (and any associated refunds) temporarily while the Division adjusts those returns to include the unemployment benefits in income and tax them accordingly.

If you receive a Rhode Island personal income tax refund for 2020 and your Rhode Island personal income tax return for 2020 was not adjusted to add back your unemployment benefits for State tax purposes, it is incumbent upon you to file an amended Rhode Island return.

Comprehensive example

Sal had income of $45,000 in 2020, including $40,000 in wages and $5,000 in unemployment benefits. When he e-filed his Rhode Island personal income tax return earlier this year, it included $40,000 (his wages) but did not include his $5,000 in unemployment benefits.

Sal must now file an amended Rhode Island personal income tax return for 2020 and include his entire $45,000 of income – including the $5,000 in unemployment benefits. He does not do so immediately. Rather, he waits to make sure that his tax software provider has updated its program to include the revised Rhode Island Schedule M and any related changes. Sal

realizes that the due date for filing his 2020 Rhode Island personal income tax return, and for making related payments, has been postponed to May 17, so he is in no rush.

Once his tax software program has been updated, Sal opens his Form RI-1040 and makes sure to check the “Amended Return” box toward the top of page one. He also checks the box toward the bottom of page one of his amended return to certify that he had sufficient health insurance coverage for all of 2020.

Sal enters — on line 2g of the revised Rhode Island Schedule M — the amount of unemployment compensation that he had excluded on his federal return. He finds that amount by looking on line 10 of the federal “Unemployment Compensation Exclusion Worksheet”.

Sal has no other modifications on his Rhode Island Schedule M. He then enters the amount from line 2g of his Rhode Island Schedule M onto page 1, line 2 of his Form RI-1040. (See screenshot below.)

Depending on how his software works, the software may make these steps for him, compute the rest of the return for him, and automatically populate various fields (such as his name and address). If not, Sal must enter that information himself.

As a final check of his amended Rhode Island personal income tax return, Sal makes sure that the amended return properly includes his 2020 unemployment compensation, and that all applicable entries are recalculated accordingly, including his tax liability.

He makes sure to include all of the schedules he included on his original return – whether they have changed or not – such as Schedule W and Schedule E. He also checks to make sure that he has included the “Explanation of Changes” supplemental page as well as Schedule M.

If he owes additional Rhode Island tax, he uses his tax software program to arrange a debit of his bank account for the applicable amount several days in advance of the May 17 due date.