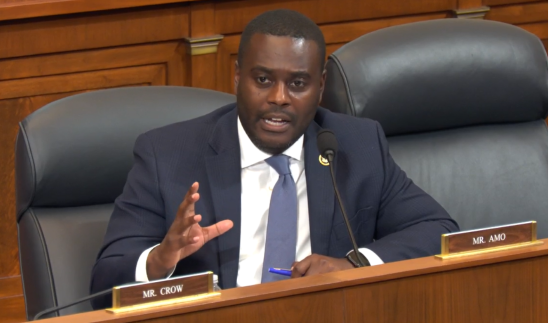

Amo Urges Using Economic Tools to Counter China’s Belt and Road Initiative

WASHINGTON, DC – Today, Congressman Gabe Amo (RI-01) participated in a House Foreign Affairs Committee hearing that focused on efforts by the U.S. International Development Finance Corporation (DFC) to outcompete China’s Belt and Road Initiative. During the hearing, Congressman Amo question Scott Nathan, the DFC’s Chief Executive Officer, about how the agency plans to use congressionally-appropriated funds to increase private investment in Ukraine and bolster its economy. Additionally, Congressman Amo asked Mr. Nathan how the DFC is working to support countries like Ghana as they seek to end their reliance on loans from China’s Belt and Road initiative.

“We know that the People’s Republic of China’s ‘Belt and Road Initiative’ is operating mass economic coercion, and we know its impact on the African continent,” said Congressman Gabe Amo. “For example, in the country where my dad was born, in Ghana, the Belt and Road Initiative has already provided about $2 billion in coercive loans for infrastructure projects. Now, China is Ghana’s largest creditor. I’d be interested to know how the DFC can work to support countries like Ghana to help end their reliance on the loans from the Belt and Road Initiative.”

Video of full hearing exchange HERE

BACKGROUND

The U.S. International Development Finance Corporation (DFC) is a U.S. government agency that uses financial tools to promote private investment, primarily in less-developed countries. It seeks to support economic development in partner countries and to advance U.S. economic interests and foreign policy aims.

Authorized by the Better Utilization of Investments Leading to Development Act of 2018 (BUILD Act) until October 2025, DFC emerged from congressional efforts to enhance U.S. development finance tools and to respond to overseas economic activity by the People’s Republic of China including the PRC’s One Belt, One Road initiative. DFC replaced the Overseas Private Investment Corporation (OPIC) and the U.S. Agency for International Development’s (USAID’s) Development Credit Authority (DCA) and was given new authorities.

Pursuant to the BUILD Act, DFC’s tools and authorities include:

Direct loans and loan guarantees of up to $1 billion for terms as long as 25 years, subject to federal credit law and other requirements, for projects and investment funds.

Political risk insurance of up to $1 billion against losses due to political risks (e.g., currency inconvertibility, expropriation, and political violence), and reinsurance to increase underwriting capacity.

Equity investment in specific projects or investment funds, with exposure limited to no more than 30% of all equity investments for a given project and no more than 35% of DFC’s overall portfolio.

Feasibility studies and technical assistance to support project identification and preparation. Recipients are generally required to share the cost of such support.

FULL HEARING REMARKS AS PREPARED FOR DELIVERY

The U.S. International Development Finance Corporation’s annual report details the ongoing work to support Ukraine’s economic resilience as it defends itself from Russia’s unlawful invasion.

This report recognizes our government’s commitment to using every available economic tool to attract private capital and support small and medium-sized businesses in Ukraine.

You yourself, Mr. Nathan, have traveled to Ukraine several times since the Russian invasion to work with the local business community.

I appreciate that you helped ensure the $1.1 billion invested by the Development Finance Corporation is used as effectively as possible to support Ukraine’s economy.

But I’m sure you would agree more must be done to support our ally and help them prepare for their post-war recovery.

The recently enacted Ukraine Security Supplemental Appropriations Act that I proudly voted for authorizes the Development Finance Corporation to use funds for economic support for Ukraine.

Mr. Nathan, how does the Development Finance Corporation plan on using the funds provided by Congress to increase private investments in Ukraine and bolster Ukraine’s economy?

The People’s Republic of China’s Belt and Road Initiative is a method of economic coercion — allowing China to grow their economic influence over foreign governments. The initiative is particularly active on the African continent.

Nearly every country in Africa receives loans from the People’s Republic of China under this initiative, giving them an increased leverage over essential supply chain routes and infrastructure across the continent.

In my father’s home country of Ghana, the Belt and Road Initiative has already provided around $2 billion in coercive loans for infrastructure projects. China is now Ghana’s largest creditor.

However, Ghanian public opinion is turning on the Belt and Road Initiative.

Mr. Nathan, how does the Development Finance Corporation work to support countries like Ghana to help end their reliance on loans from the Belt and Road Initiative?