Congressional Delegation Encourages Rhode Islanders to Take Advantage of Expanded, Improved Child Tax Credit

PROVIDENCE – Rhode Island’s Congressional Delegation held a press conference with the United Way this morning to encourage eligible Rhode Islanders to take advantage of the expanded, improved Child Tax Credit that Congress established through the American Rescue Plan earlier this year. Eligible Rhode Islanders can take advantage of the Child Tax Credit when filing their federal income taxes, which are due one week from today, May 17th.

“Democrats and President Biden passed this tax cut to put money in the hands of parents. That’s concrete help when it comes to a family’s taxes, and we’re going to keep pushing to make this tax credit permanent and reverse the Trump tax cut plan’s giveaways to the wealthiest. With millions of dollars available, Rhode Island families should remember to file by the May 17th tax deadline,” said Senator Reed.

“Our American Rescue Plan is the biggest piece of legislation to help working Rhode Island families in decades, and the newly expanded Child Tax Credit is a major part of it,” said Senator Whitehouse, Chairman of Senate Subcommittee on Taxation and IRS Oversight. “The larger Child Tax Credit will help lift families into the middle class and get an entire generation of children off to a stable, strong start. I urge every family with kids to file their 2020 taxes on time so they can receive the new monthly benefit starting this summer.”

“Thanks to the American Rescue Plan Act, our nation is on the verge of slashing child poverty in half,” said Rep. Langevin. “I’m deeply proud of our work to step up and deliver for Rhode Island’s working families, and I look forward to the expanded Child Tax Credit providing up to $300 per child in monthly payments to families across the state. I encourage all Rhode Islanders to file their tax returns by May 17th to take advantage of the tax relief they deserve.”

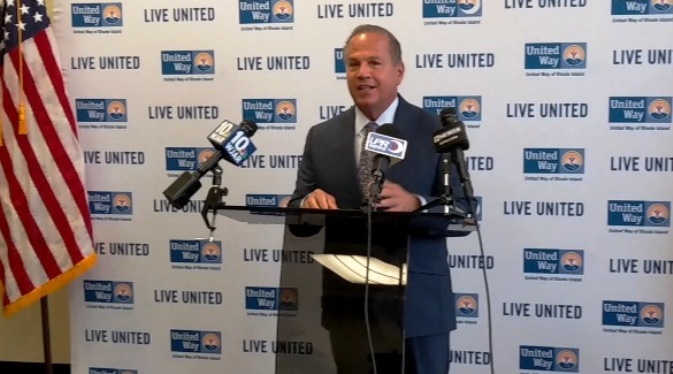

“The changes we made to the Child Tax Credit will lift millions of kids out of poverty, including 6,600 here in Rhode Island,” said Congressman David N. Cicilline (RI-01). “This is a historic moment. It’s critical that we make sure every eligible Rhode Islander takes advantage of it.”

“The expansion of the Child Tax Credit and the ability to receive the credit as a monthly installment will provide Rhode Island families with much needed stability and opportunity. Through 211 we are proud to connect thousands of Rhode Islanders with VITA, the Volunteer Income Tax Assistance Program. If you need help with your taxes, just call 211 and we will connect you with assistance in your community,” Larry Warner, Chief Impact and Equity Officer, United Way of Rhode Island said.

“The expanded, improved Child Tax Credit will improve the lives of thousands of Rhode Island families, many of whom will use the VITA program to prepare their taxes and access economic assistance,” said Allori Fernandes of Federal Hill House, which offers free tax prep services through VITA. “We’re grateful that the Congressional Delegation is continuing to fight for Rhode Island families.”

The historic expansion and improvement of the Child Tax Credit, secured through the American Rescue Plan, will provide children and families with additional payments throughout the year that helps them with the costs of food, childcare, diapers, healthcare, clothing, and taxes. The full Child Tax Credit is now available to children in families with low or no earnings in a given year.

In addition, the maximum Credit amount has been raised to $3,000 per child and $3,600 for children who are younger than six years old. The Credit has also been expanded to 17 year olds, who were not previously eligible. 27 million American children will benefit directly, including more than 173,000 kids living in Rhode Island. An estimated 6,600 Rhode Island children will be lifted out of poverty.